Many retail FX trading platforms online extend credit to their clients. Speculating with borrowed money can help you yield bigger profits, but it is also very risky since you can end up losing more money than what you own. The debts won’t go away just because you close your account with the platform.

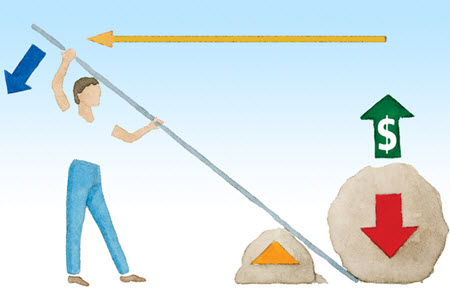

In the world of FX trading, speculating with borrowed money is known as leveraged FX trading.

How does it work?

Many retail FX trading platforms that extend credit to their clients will require that you open a margin account (although they might use another term for it, and some simply use your trading account as the margin account).

Many retail FX trading platforms that extend credit to their clients will require that you open a margin account (although they might use another term for it, and some simply use your trading account as the margin account).

The assets in your margin account will be security for your loan, and the value of the assets in the account will therefore impact how much money you are allowed to borrow for your trading. If the value of the assets in the account drops below a certain limit, the platform will either just sell off your assets autmatically to protect themselves from an even deeper drop, or ask you to immediately put more money/assets into your margin account to avoid a forced sell-off.

FX trading platforms are famous for offering very big credits in relation to the size of the security. There are many examples of platforms where a trader in good standing can borrow $100 on a $1 security. Some even offer $200 loans on $1 security if the account is large enouch (typically $50,000 or more).

Example

- You have €2,000 in your margin account.

- The platform offers you 50:1 leverage. This means that for each euro in the margin account, you can borrow €100. With €2,000 in your account, you can thus borrow €100,000.

Why use leverage?

On the FX market, a trader will typically make a profit from tiny exchange rate fluctuations. If you are investing small amounts of money, e.g. $50 here and there, the profits will typically be small even when you do make a profit.

By using leverage, you can turn those small profits into big profits, since you are risking more money. A 0.05% profit on $100 is $5. A 0.05% profit on $100,000 is $5,000.

Of course, risking more money also means that you run the risk of having big losses instead of small losses.

Why are retail FX brokers so eager to offer leverage?

FX retail brokers (trading platforms) typically have a business model where you (the trader) pay for each transaction you make on the platform. Fees can be either fixed or a percentage of the trade size, or a combination of both.

With this business model, the broker will profit more if you turn over a lot of money instead of a little money. They lend you money so you can make more trades / larger trades, since this translates into more money for them.

Remember: The broker/platform makes money on all your transactions. To them, it doesn’t matter if you gain money or lose money on the trade.

Also, leverage makes it more fun to be a trader, since you are making more money when your trading is going well. A trader who actually makes a significant amount of money when they profit is more likely to continue trading and feel like the effort put into the trading is worth it.

This article was last updated on: March 13, 2019