The foreign exchange market, also known as the forex market or the FX market, is a global decentralised market where currencies are traded. Today, a wide range of contract types have been developed to facilitate not just trading in currencies but also more complex forms of FX speculation, where FX speculators hope to make a profit from fluctuating currency rates.

The modern foreign exchange market developed as a response to international trade, where companies and organizations needed to exchange currencies to carry out international purchases. Because of the constantly fluctuating demand and supply of the various currencies, the foreign exchange rates will fluctuate, and successful FX traders know how to turn a profit from this.

There are a large amount of retail brokers who offer forex trading. It is important to chose a broker that offer good trading tools and low spreads. Doing so will increase your chances of earning money on the forex market.

Latest Posts

-

The Role of Oracles in Smart Contracts and Blockchain

-

What is Yield Farming in Crypto?

-

The Impact of Bitcoin Halving on the Crypto Market

-

What is a Rug Pull in Crypto and How to Protect Yourself?

-

How to Spot and Avoid Cryptocurrency Scams

-

What is a DAO (Decentralized Autonomous Organization)?

-

Understanding Gas Fees on Ethereum and Other Networks

-

What is a Crypto ICO (Initial Coin Offering)?

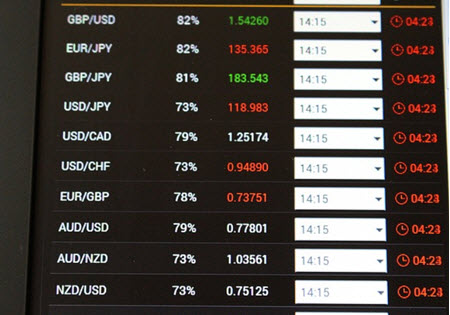

What are forex pips?

Pip is a unit for expressing value changes in a currency pair.

When you first start dabbling in forex trading, you will come across a lot of new words and terminology that is important to know. One of the words that you need to learn early on is pips. In your life up until now, pips have probably been the small hard seeds in citrus fruit. But in the world of forex trading, pips are something quite different and stands for percentage in point.

Traditionally, the smallest possible change that could be displayed as 1 pip, but today, there are trading platforms available online that will show fractional pips too – sometimes all the way down to 1/10 pip.

For most of the commonly traded currencies in the world, the pip will be the fourth decimal. There are exceptions, and a notable one is the Japanese yen where the pip is the second decimal.

Example: The exchange rate for the currency pair EUR/USD was 1.1412 and changed to 1.1419. That was a 7 pip increase. The exchange rate then changed to 1.1417, i.e. a 2 pip decrease.

Traditionally, FX traders have been buying and selling positions consisting of 100,000 units of the base currency. With such a position, a 1 pip increase means that the value of the base currency has increased by 10 units of the other currency.

Example: The exchange rate for EUR/USD is 1.3000. This means that 1 Euro = 1.3 USD.

The FX trader purchases five standard-sized positions, i.e. 5 positions á 100,000 units each of Euro. The trader pays 650,000 USD to obtain 500,000 EUR.

The exchange rate changes from 1.300 to 1.310. This is a 10 pip increase. The trader is happy and sells his five positions for 650,500 USD. He made a 500 USD profit.

Who is behind the transactions?

A wide range of actors are active on the FX market. Here are a few notable examples

- National central banks

- Large import- and export companies

- Currency exchange companies

- Money transfer companies

- Hedge funds

- Investment management companies

- Retail currency platforms/brokers who allow small-scale traders to carry out currency trading on their platforms or through them

Where is the forex market?

The forex market isn’t a specific market (such as the New York Stock Exchange or the Chicago Mercantile Exchange). Instead, it is a decentraliserad (mostly digital) network of large, mid-sized and small markets where currency is exchanged.

Two very important trading spots within this network are Thomson Reuters Dealing and the Electronic Broking Services (EBS). EBS is owned by ICAP plc.

Retail FX traders

Today, it is easier than ever before for ordinary individuals to make a profit from FX trading, since there are many platforms available online where you can make a small deposit and engage in currency speculation without being backed by a huge hedgefund, investment management company, or similar. You don’t need to obtain access to major hubs such as EBS – you simply do all your speculation on the platform. This is known as retail FX trading. I recommend that you visit DayTrading.com if you want to learn more about retail FX trading.

When the first platforms for retail FX trading began to appear in the late 20th century, they were very crude and some were quite buggy. Today, you can chose among a wide range of sofisticated and well-functioning platforms, that in addition to trading also offers you 24/7 economic news, statistics, webinars, tools for technical trade strategies, and more.

Many platforms are available for trading directly in your web browser, so you don’t have to download and install the platform on your computer. Some platforms are even adapted for trade on mobile touch-screen devices, such as smartphones and tablets.

Important: Never forget that FX trading is a risky business and you can rapidly lose everything you deposited and earned. If you decide to trade using leverage (credit), it is actually possible to lose more than you own and end up in debt! Never speculate with more than what you can afford to lose.

Regretably, a booming sector such as retail FX trading online will attract not just reputable companies but scammers and fraudsters as well, plus a selection of companies that might be doing their very best but simply aren’t very good at what they do. It is therefore very important to be careful and do your research before signing up and depositing.

How to Get Started With Forex Trading

Getting started with forex trading is easier than ever, but actually making it a consistent profit instead of blowing up your account or getting scammed requires considerably more work than just opening an app and clicking “Buy.”

The forex market’s massive, it runs 24/5, and you can trade it from anywhere from whence you can get access to an online trading platform. It is appealing to beginners, but if you want to go from casually curious to seriously capable, there are a many things you’ll need to get right.

Below, we have gathered information that can help you approach forex trading in a serious fashion and give yourself a better chance at becoming a long-term profitable forex trader online.

Choose a Trading Style That Suits You

Your trading style needs to match your schedule, personality, and energy level. If you can not be completely present and focused during intense day trading sessions, go for another style, such as swing trading or position trading. If, on the other hand, the idea of handling overnight risks gives you hives, day trading may be your thing, especially if you also like active and intense trading, and can dedicate uninterrupted time to the screen during day trading sessions.

What matters is that you build a routine around a style you can actually stick with. Trying to force a strategy that doesn’t fit your lifestyle and temperament is one of the fastest ways to burn out from stress or wipe our your account – which ever happens first.

Don’t Skip Risk Management

Here’s where most new traders blow it. They spend weeks building a strategy, obsess over entries, but barely think about what happens when the trade doesn’t go their way. They trade too big, open too many positions, spread themselves too thin, fail to place appropriate stop-loss orders, and take risks that means they are always just one bad loss away from to erasing nearly all their wins.

You’re not trying to win every trade. You’re trying to stay in the game despite the losses, and that means controlling how much of your capital is exposed at any given time. Keep your positions small — 1% to 2% of your account per trade is enough to make progress without putting yourself in danger each time the market moves against you.

Every trade should have a defined stop-loss and a clear exit plan. You should know what you’re risking before you even open the trade. Not just emotionally — but numerically. If you can’t say “I’m risking $50 to potentially make $100,” you’re gambling, not trading.

You need to have routines in place to reduce the risk of emotional trading in the heat of the moment, and that including using stop-loss orders and take-profit orders in a smart way, while also limiting position size.

You risk management plan should be written down. It needs to be clear and include rules that are not vague or open to interpretation.

Regularly follow up and see if it needs any adjustments. Adjustments should be made when your positions are closed and you are calm, otherwise you will just start adjusting your risk-management plan in the heat of the moment to avoid breaking it.

The Trading Platform

You need a trading platform that is stable, secure, easy to use, and suitable for your trading style. It should also ideally include the tools your need for your strategy, e.g. technical analysis tools.

Make sure you can place the type of orders you need, e.g. trailing stop-loss points instead of just fixed stop-loss points.

Many forex brokers will give you access to one of the big third-party trading platforms, e.g. MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader, but there are also brokers who have their own proprietary platforms. It is a very good idea to test the platform using a free demo account before you sign up with any broker.

MT4 and MT5 are both great platforms, but MT5 has a somewhat larger tool box when it comes to technical analysis. Still, many fx traders prefer MT4, since it is more focused on forex and less focused on stocks etc. The trading platform cTrader is also very popular, especially among traders who need access to more advanced order types.

Don’t get obsessed with flashy dashboards or complex indicators you don’t need. A clean price chart, a functional order window, and a way to manage stops and targets are all you really need at the start. You want the platform to do what you tell it to do — no lag, no funny business, no slippage that always goes against you.

Why Using A Free Demo Account is Great

Before you sign up with a broker and make any deposit, it is a very good idea to open a free demo account filled with play-money and use it.

- You can see if the platform is suitable for your preferences, your trading strategy and your risk-management routines.

- You get to learn how to use the platform risk free, and if you slip up and do a few beginner mistakes you are only losing play-money.

- You can see how your trading strategy and risk-management plan stacks up against real price data. Maybe you need to do a few adjustments before you start risking your own hard-earned cash.

- You can work your routines into your backbone, which will make it easier to stick to them in the future – even under stress. When you are using the demo account, don´t go crazy, because that can build poor habits. Trade in accordance with your trading strategy and risk-management plan, to make sure that is how you program your brain.

If a broker is reluctant to let you open a free demo account without making a deposit first, that is a red flag. Brokers that know they have something great to offer are 100% happy to let your open a free demo account, and they will fill it with plenty of play-money and let you use it for a long time without forcing you to complete the full sign-up or deposit any money.

Regrettably, the Demo Account Will Not Let You Practice How To Manage Your Emotions

Demo accounts are useful for getting comfortable with the platform and testing basic setups, but they don’t teach you how to handle the emotions that will surface when you switch from play-money to real money. The minute you put real money on the line, everything changes — your focus, your discipline, your ability to follow your plan.

Start in demo to learn the mechanics. Once you’re confident placing orders, managing trades, and reading charts, move to a live account — but keep your position size tiny, even if you feel super confident after all your success in the demo account. Focus on executing your trading strategy and sticking to your risk-management plan. Build the habit of trading according to your rules even when the money is real. The goal in the beginning isn’t to get rich. It’s to not get wrecked while you figure out what actually works for you.

Spend Time Learning the Market Hours and Pair Behavior

Just because forex runs 24 hours doesn’t mean it moves the same way all day. Different sessions bring different levels of volatility, and different pairs behave differently depending on the time of day. The London and New York sessions are where most of the real action happens. That’s when major economic news drops, when banks and institutions are active, and when you’ll see the tightest spreads and cleanest moves. If you’re trading pairs like EUR/USD, GBP/USD, or USD/JPY, this is when you want to be watching. Outside those hours, markets slow down — especially during the Asian session unless you’re trading yen or AUD-based pairs. Understanding when the market tends to move and when it’s just drifting saves you from sitting around staring at candles that aren’t going anywhere.

Focus on One or Two Pairs at First

When you’re starting out, it’s tempting to watch every chart, chase every move, and load your platform with 20 pairs. Don’t. Pick one or two major pairs and study how they behave. Get to know their rhythm, their reaction to news, and how they move during different sessions. Major pairs like EUR/USD and GBP/USD tend to have tighter spreads, cleaner trends, and more predictable behavior than exotic pairs. Fewer variables, fewer surprises. Once you’re consistently profitable with one or two pairs, you can expand if you still want to. Trying to master everything from day one and jump at every opportunity just leads to scattered trades and zero clarity.

Don’t Skip the Fundamentals

Even if you’re trading based on technical analysis, you still need to know what news is coming. A clean breakout setup on EUR/USD can blow up instantly if it happens ten minutes before the Fed announces interest rate changes. Use an economic calendar. Know when high-impact events are scheduled. If you’re new, consider staying out of the market during those events entirely. You can always trade the reaction — you don’t need to guess the news. If you’re more fundamentally inclined, learn how monetary policy, inflation, GDP, and employment data affect currency value. It’s not about knowing everything — it’s about knowing what matters and when it matters.

Different Types and Styles of Currency Trading

Foreign currency trading — also known as forex trading — gets sold as a 24/5 market full of fast profits, global drama, and endless opportunity. And sure, that’s is all true. The market is massive. It moves around the clock five days a week, and it reacts to everything from central bank policy to political risk. No wonder it attracts everyone from international banks to solo traders working from a laptop at 3am.

But the forex market is also filled with risks and pitfalls, and simply “winging it” is not a good idea. Once you’ve decided to become a forex trader, the real question becomes how you want to trade forex. Are you trying to ride intraday trends, catch swing moves, capitalize on rate differentials, or just take quick shots at news events? Currency trading isn’t one style — it’s a whole spectrum. And what works for one trader might be total chaos for someone else.’

Below, we will look at a few different forex trading styles.

Day Trading

Day trading currencies is exactly what it sounds like — opening and closing positions within the same trading day. You’re not holding anything overnight and you’re definitely not building long-term portfolios. You’re watching short-term charts, reacting to price action, and trying to catch clean moves over minutes or hours.’

Most day traders work off technical setups — support, resistance, breakouts, reversals, volume shifts. They might use indicators like moving averages, RSI, or VWAP, but the core skill is reading price and managing risk in real time. Slippage, spreads, and news volatility can make or break a session.

This style suits traders who like control. You know your results at the end of the day. No surprise gaps, no overnight risk. But it’s mentally demanding during the trading session. You need to be focused, sharp, fast, and decisive. If you’re emotional, distracted, or undisciplined, the market will eat you alive before lunch.

Scalping

Scalping is one of the day trading strategies – and it is extremely fast. You’re opening and closing trades in seconds or minutes, trying to capture tiny price movements — often just a few pips at a time. It sounds simple, but it’s not an easy way to trade.

Scalpers thrive on precision and discipline. You’re not looking for big wins — you’re stacking small ones. That means you need super tight spreads, super fast execution, and extreme control over your emotions. You get in, you get out. No debating. No hoping.

This style doesn’t tolerate hesitation. One bad trade can erase ten small wins. And it doesn’t work with just any broker, platform or currency pair — you need low latency, high liquidity, and ideally, no dealing desk interference.

For some, scalping feels like a natural fit — especially if they enjoy high-adrenaline trading. For others, it’s pure stress and noise.

A positive aspect of scalping is that you can make money even when markets are seemingly stagnant, since you are profiting from such tiny moments. While traders looking for clear trends are pulling their hair, you work with minute movements.

Swing Trading

The Website SwingTrading tells is that Swing traders look for bigger moves that take days — sometimes weeks — to play out. Under some circumstances, a swing trader might even hold out for a few months. They’re not glued to the screen all day like a day trader, but they still pay attention to technical structure and economic momentum.

The idea is to catch the “meat” of a move — after confirmation, but before the trend fades. A swing trader might buy EUR/USD after a central bank surprise, or short AUD/JPY on risk-off sentiment, holding for a few days while the market adjusts.

This style works well for people who want to trade with structure but don’t want the pressure of intense day trading. It’s slower, calmer, and often more forgiving. You’re using wider stops, watching higher timeframes, and focusing more on context than fast execution.

But don´t be fooled into thinking swing trading is easy, effortless or low-risk. It requires a lot of work behind the scenes and trust in your setup. When you’re holding through overnight sessions, random volatility can shake you out if your position sizing or conviction is weak.

Position Trading

Position traders have a longer time-horizone than swing traders, although sometimes their commitment times overlap. Position trading can look similar to investing, but is still considered trading, and position traders do not employ buy-and-hold strategies.

Position traders don’t care about five-minute candles. They’re focused on fundamentals — interest rate cycles, inflation, economic data trends, monetary policy. These traders typically hold positions for several months or even longer, riding large macro moves based on economic shifts. This style requires patience and a lot of background knowledge. You’re watching central bank language, labor markets, inflation prints, trade flows. You’re not reacting to noise — you’re building a thesis and holding through the market’s ups and downs.

Risk management is different here. You’re using much wider stops, much smaller position sizes, and often hedging across correlated pairs. The reward is larger moves, often hundreds of pips, but the drawdowns can be significant. You have to trust your analysis and be comfortable being early — or temporarily wrong. Position trading isn’t glamorous, and it won’t deliver daily dopamine hits. But it reflects how many of the big players think — and if you’ve got the time and discipline, it can be a powerful style.

News Trading

Some traders are always on the lookout, ready to throw their hat into the ring and trade on news when the right situation appears. Their actions can seem random and highly spontaneous, but the long-term profitable news traders tend to be quite the opposite. They follow the news and the economic calendar with a keen eye, and they know how to read a situation in the blink of an eye and take calculated risks.

Fast, aggressive moves that happen around scheduled economic events like NFP, CPI, interest rate decisions, or speeches by central bankers create suitable dynamics for news traders. The idea is simple: major news can move currency markets fast. Get in at the right time, with the right direction, and the payoff is big. Get in late, or guess wrong, and your position can blow up in seconds.

This style is all about timing and reaction. You need to know the calendar, understand the forecast vs actual dynamic, and have a clear plan for execution. Most brokers widen spreads and limit execution speed during these moments, so you’re also battling platform mechanics — not just the market.

Some news traders straddle both sides of a news event with options. Others fade overreactions. Some use tight straddle orders with predefined stops. No matter the approach, news trading is risky. The edge isn’t just in knowing what the data says — it’s in knowing how the market will react to it, which isn’t always logical.

Algorithmic Trading

Some traders use specialized software (“trading robots”) and employ algorithmic strategies that enter and exit trades automatically based on coded rules. These systems can scalp, swing, trend-follow, mean-revert, and more.

Everything is programmed in advance, and the trading robot is continuously scanning the market, ready to act when it detects a situation that fits the code. The algorithm doesn’t panic, doesn’t chase, and doesn’t second-guess – it just acts the way you programmed it.

Algorithmic traders must be ready to spend plenty of time designing and testing. They build the logic, test it against historical data, and deploy it with risk controls in place. Some use platforms like MetaTrader with Expert Advisors. Others use Python, FIX APIs, or custom-built infrastructure.

This style works better if you’re analytical, data-driven, and more interested in building systems than diving in hot. But it still carries risk. Markets evolve, edges decay, and over-optimization (curve fitting) is a real trap. Even a good system needs regular review.

Hybrid Traders

As a novice trader, it is advisable to stick to one strategy, because otherwise you might be spreading yourself too thin during this early stage of your forex trading career. More experienced traders can afford to branch out a bit, if they want to. A swing trader might scalp during especially opportune days. A position trader might hedge with short-term options. A news trader might scale into longer-term macro plays. The best traders know their own rhythm, risk tolerance, and mental energy. They don’t force a style that doesn’t fit. They build their approach or approaches around who they are — not just what works in theory.

Learn Forex Basics

Before you pick a broker and start trading forex, it is advisable to learn at least the basics. You do not need a four-year degree in economics, finance and global trade relations, but it is a bad idea to just jump into forex trading without understanding the fundamental terms and forces.

Below are a few examples of points that you should study more in-depth before you put any real money on the line.

Currency Pairs

In the forex market, currencies are always traded in pairs. You are always buying one currency and paying for it using another currency.

Example: The most traded currency pair on the forex market is EUR/USD. If the exchange rate for the EUR/USD is 1.20 it means that 1 Euro can be exchanged for 1.20 USD.

The first currency in a currency pair is called the base currency, and the second currency is called quote currency (or counter currency). In the example EUR/USD, the Euro is the base currency and the U.S. Dollar is the quote currency. The exchange rate 1.20 denotes how much of the quote currency (USD) is needed to buy 1 unit of the base currency (EUR).

If you think the U.S. Dollar is about to strengthen in value against the Euro, you can decide to purchase U.S. Dollars and pay for them using Euro. If your prediction comes true, you can sell the USD and get paid in EUR – and get more EUR than what you originally paid for the USD. This is the foundation of forex trading.

The Most Traded Currency Pairs

The following seven currency pairs are the most commonly traded on the global forex market.

- AUD/CAD

- AUD/JPY

- AUD/USD

- CHF/JPY

- EUR/AUD

- EUR /CAD

- EUR/CHF

- EUR/GBP

- EUR/JPY

- EUR/USD

- GBP/CHF

- GBP/JPY

- GBP/USD

- NZD/USD

- USD/CAD

- USD/CHF

- USD/JPY

- AUD/NZD

As you can see, each of these pairs match a major currency with the United States dollar.

Of these seven fx pairs, the EUR/USD is by far the most traded, and it accounts for roughly one-third of the total transaction volume on the forex market.

Pips

One pip is the smallest unit of measurement for price movements in traditional currency trading.

Today, some fx trading platforms will also show fractional pips, which means that even smaller movements than 1 pip become visible.

The Global Forex Market

The global forex market is larger (by trading volume) than any of the other financial markets, and it is also the most liquid – although liquidity can vary a lot depending on which currency pair you are looking at. In 2022, the equivalent of 7.5 billion USD was traded on the forex market in an average trading day.

There is no single centralized exchange and the forex market is largely an over-the-counter (OTC) market, which comes with its own set of risks, although futures contracts are exchange-traded, which reduces counterparty risk. Trading is done electronically, through a network of computers.

The forex market´s official trading hours are 24 hours a day, Monday through Friday. Since the globe consists of different time zones, trading will start first in places like Tokyo and Sydney when it is Monday morning in their respective time zones, and gradually open up towards the west, eventually reaching hubs such as London and New York City. The market is therefore active from 17:00 Sunday afternoon Eastern Time (ET) to 17:00 Friday afternoon Eastern Time (ET).

The trading that takes place during this long session continuously determines the market price of different currencies against each other, as the market moves based on supply and demand.

Spot, Forward, Futures, and Options Contracts

Forex speculation can take place on the spot market, but it is also possible to use derivatives such as fx forwards and fx futures.

- The fx spot market is where currencies are exchanged between buyers and sellers at the current exchange rate.

- An fx futures contract is a highly standardized contract where two parties commit to exchange a certain amount of one currency for another, at a pre-specified exchange rate, at a predefined time in the future. Fx futures contracts are exchange-traded.

- An fx forward is a tailormade contract. It is similar to an fx futures contract, but is not standardized and not exchange-traded. The contract is privately negotiated between the two parties to suit their specific needs.

- An fx option give its holder the right, but no obligation, to carry out a predefined currency transaction, with a predefined exchange rate, at a certain date in the future. Fx options are not exchange-traded.

Who Are the Players?

Here are some examples of key participants in the forex market:

- Central Banks Around the world, central banks employ various techniques to impact how their national currency is valued against other currencies. A lot of this work is done through interest rates, but central banks can also involve themselves actively in the buying and selling of currencies on the fx market.

- Commercial Banks Commercial banks provide a lot of liquidity on the forex market, as they trade to hedge or speculate on behalf of their clients.

- Hedge Funds

Many hedge funds are active on the forex market on behalf of their clients. - Corporations A company based in Country A will need to get its hands on the official currency of Country B to pay its bills, if it is doing business with a company in Country B who will only accept that currency. Many large corporations engage in the forex market on a daily basis. In many cases, they are hedging, to protect their operations from wild swings in exchange rates.

- Money Transfer Companies In the 21st century, this industry has grown a lot, as new businesses compete with the well-established big banks when it comes to the exchange and transfer of currencies from individual to individual, often working rapidly across borders and offering better terms and conditions for their customers.

Different Types of Forex Brokers

As a retail forex trader, you speculate on forex through a broker — and that broker is your middleman, your execution partner, and, in some cases, the one taking the other side of your trade. It all depends on which type of broker you pick and which instruments you use for your forex speculation.

Understanding what type of broker you’re dealing with is really important, as it directly affects how your orders are filled, how your spreads behave during volatility, and whether your broker’s profit comes from helping you trade better or hoping you lose.

Most brokers fall into a few core categories, each with different ways of handling your trades. Some send your orders to the market. Some handle them in-house. Some offer tight pricing with raw execution. Some dress up the spread and market themselves as commission-free. None of these models are automatically good or bad — but if you don’t know who you’re trading with, you don’t know what game you’re playing. You need to know the pros and cons so you make informed decisions.

Market Makers

Market makers are also known as dealing desk brokers (DD brokers). They create their own internal market for you to trade in, meaning they take the other side of your trade. When you buy, they sell. When you sell, they buy.

The upside? These brokers can offer fixed spreads, instant execution, and no reliance on outside liquidity. That makes things smooth, and beginners and casual traders tend to love it. You always get filled and you know what you’re getting. The trading environment is stable and spreads are predictable.

The downside? The built-in conflict of interest. If you win, the broker loses. And if you lose, that’s profit for them. Some market makers are legit and run a fair operation. They make their money by having long-term happy clients who know they are trading in a fair environment. Shady brokers, on the other hand, can abuse their power in various ways to ensure a bigger profit. e.g. by delaying your execution, showing incorrect prices on the platform, deliberately widen your spreads during volatility, or even reject profitable trades under sketchy excuses.

If you’re going to use a market maker broker, make sure they’re regulated by a serious financial authority that carries out useful supervision and is ready to act when they see something suspicious.

STP Brokers: Straight Through Processing

STP stands for Straight Through Processing. These brokers don’t hold your trades in-house. Instead, they pass your orders directly through to their liquidity providers — usually banks, hedge funds, or larger brokers — who fill your trades on the open market.

There’s no dealing desk. No internal matching. No betting against your position. The broker acts as a bridge between you and the real market and is never your counterpart in a trade. STP brokers earn money through a markup on the spread and/or a commission per trade, but they’re not sitting there hoping you blow up.

With STP brokers, execution tends to be fast, slippage is more realistic, and spreads are often variable depending on market conditions. If liquidity is high, you get tight spreads. If things get volatile, they widen — but at least it’s market-driven, not broker-controlled.

This model suits traders who want transparency and are okay with a bit more rawness in exchange for honesty. If you’re serious about execution and don’t want to second-guess your fills, an STP broker is a solid choice.

ECN Brokers: Electronic Communication Network

ECN stands for Electronic Communication Network. This is the cleanest, most direct way to trade forex — and the closest thing to real market access in the retail world. An ECN broker connects you directly to a network of banks, institutions, and other traders. Your trades are matched with other participants in real time. Prices are determined by supply and demand. Spreads can get razor-thin, especially during peak sessions, but you’ll usually pay a commission on each trade.

There’s no interference, no price shading, and no conflict of interest. The broker earns their cut whether you win or lose, and they’re not in the business of manipulating your trades.

The catch? ECN trading isn’t always beginner-friendly. Spreads can spike dramatically during news. Slippage can happen. Orders can get partial fills. You’ll need to manage your risk tighter, and you may need a larger minimum deposit to even be allowed to start trading.

If you’re scalping, trading during volatile events, or just want full transparency, ECN brokers give you the closest thing to a level playing field.

Brokers That Offer Multiple Account Types

Some brokers mix the models. They can for instance offer a standard account with dealing desk execution, and a pro account with STP or ECN routing. Others route small trades internally but send larger trades out to liquidity providers. Some handle retail clients in-house but institutional clients externally.

Hybrid brokers aren’t automatically bad — in fact, many reputable ones operate this way to balance cost and execution quality. But if a broker can’t clearly explain how they handle your orders and who fills them, that’s a problem.

The more you know about the routing path of your trades, the better. If the broker’s answer sounds vague, overly polished, or buried under marketing language, assume they don’t want you to look too closely — and that’s your cue to leave.

So, Which Type Is Best?

That depends on your style, size, skills, and expectations. There’s no one-size-fits-all answer. The best broker is the one that fits your trading style, needs and preferences, plays fair, and doesn’t get in your way. Whether that’s STP, ECN, or a reputable market maker depends on what you’re trying to do.

If you’re brand new and trading small size, a decent market maker with fast fills and a simple platform might be all you need — as long as they’re regulated and transparent.

If you’re looking for cleaner execution and fewer conflicts, STP is a safer bet. You’ll get real market pricing, variable spreads, and fewer surprises.

If you’re experienced and want pure, institutional-style access with tight spreads and full transparency, ECN is the way to go — just be ready for commissions, possible slippage, and the raw realities of the market.

How to Select a Forex Broker

Picking a forex broker is a crucial decision that can make or break your forex trading experience. Forex trading happens off-exchange. There’s no central hub, no NYSE or Nasdaq equivalent. It’s broker-driven. That means the broker is your lifeline — for quotes, execution, spreads, margin, withdrawals, the whole thing. If they’re shady, slow, or just plain bad, your edge dies right there.

Below, we will take a look at few things that are good to keep in mind when you compare different forex brokers. You can compare brokers based on these any many other key indicators by visiting BrokerListings.

Regulation

This is the starting point. If the broker isn’t regulated by a reputable financial authority with strict trader protection, stop right there. You’re giving someone your money and trusting them to play fair. You want to pick a broker that is serious enough to be licensed and regulated by a reputable financial authority with proper trader protection rules, such as the FCA in the UK, ASIC in Australia, CFTC/NFA in the US, CySEC in Cyprus, and BaFin in Germany. These agencies require brokers to keep client funds separated from company funds, submit regular audits, and follow strict standards around transparency and client protection.

If the broker is regulated in some random offshore island where the only official building is a post office, you’re on your own. No oversight means brokers can manipulate prices, deny withdrawals, or disappear with your deposit — and there’s no one who will take any action against the broker when it happens.

Good brokers are upfront about their regulation. If you have to dig to find it — or it’s nowhere to be found — move on.

If you want a clear-cut situation when it comes to jurisdiction, pick a broker regulated in your country. That means ASIC if you live in Australia, the FCA if you live in the UK, and so on. For traders in the European Union, a broker licensed by any of the membership countries will do. If an issue arises, you will be happy that you are not trying to complain to a financial authority on the other side of the globe, who might very well be strict and launch an investigation, but has zero rights to really intervene on your behalf in your country. Two (or more) legal systems trying to cooperate can be a very drawn-out nightmare for the trader.

Execution Speed

Fast execution doesn’t just mean your trade fills quickly. It means it fills where you actually clicked — not a few pips worse because of “technical reasons” or suspicious slippage that always seems to go against you. If your style depends on quick entries and exits — scalping, day trading, news trading — execution speed is non-negotiable. Ask other traders. Read real reviews, not the sponsored ones with affiliate links.

As mentioned above, dealing desk brokers (market makers) aren’t inherently bad, and many run legit operations with a lot of benefits for the trader. But the conflict of interest is baked in, and if you dislike that, you need to look for brokers that offer true STP (Straight Through Processing) or ECN (Electronic Communication Network) execution. That means the broker is not running an internal dealing desk and taking the other side of your trades.

Spreads, Commissions, and Other Fees

Brokers usually make a bulk of their money from a combination of spreads and commissions.

Spread is the difference between the bid price and the ask price at your broker. As a trader, you want tight spreads. Major pairs like EUR/USD and USD/JPY will usually have the tightest spreads, especially during London and New York sessions.

Some brokers charge a fixed or percentage-based commission per lot. Others bake their fees into the spread. Know how your broker gets paid. And make sure there’s no fine print about “dynamic spreads” that triple during volatile periods.

Don’t fall for marketing claims like “zero spread” without checking how they make their money elsewhere — they could be marking up commissions or padding swaps. On that same note, be careful with Zero Commission Brokers; check their spreads and other costs before you proceed.

In addition to spreads and commissions, brokers can also charge a variety of other fees. Here are a few examples of things to look out for:

- Deposit processing fee

- Withdrawal processing fee

- Platform fee

- Inactivity fee

- Overnight fee or swap fee (for positions kept open over night)

Last but not least: Tight spreads are good. Low commissions are good. No transaction fees on deposits and withdrawals is good. But being promised ultra-low spreads, zero commissions and no transaction fees by an unregulated broker that may or may not freeze your withdrawals or manipulate price information? Not so good. Always look at the whole picture before making a decision. Costs matter a lot — but only after regulation, execution, and platform stability are sorted.

Platform

Many forex brokers offer MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader. All of these third-party independent trading platforms are solid, widely used, and feature-rich. The one you choose depends on your trading style. MT4 is still the standard for forex. MT5 supports more assets and order types, and is a bit stronger when it comes to technical analysis. cTrader has cleaner execution and depth of market tools.

Some brokers also have their own custom platforms. These can be great — or terrible. Try the demo first. If it feels clunky, glitchy, or more like a mobile game than a trading tool, it’s not made for serious traders. The platform should feel reliable. It shouldn’t freeze when volatility hits. Your charts should match your quotes. Orders should go through instantly unless the market genuinely can’t fill them.

Account Types

Some brokers offer several account types: standard, ECN, pro, raw spread, whatever they want to call it. The difference usually comes down to spread vs. commission and how orders are processed.

The important thing is not the exact label, but to know what you’re getting. If one account type is commission-free but has wider spreads, calculate what it’s really costing you on your trade size. If another offers tight spreads and a flat fee, see which one’s cheaper in real-world conditions — not just the marketing copy.

Leverage

Leverage is a tool that can help or destroy you, since it will boost both profits and losses. High leverage looks attractive until it swings against you and wipes out your account in seconds. Use it carefully, and don´t let the broker bait you into oversized trades by dangling big position sizes in your face.

Many of the stricter financial authorities – such as UK FCA, ASIC, and CySEC – have caps in place that limit how much leverage a broker is permitted to give a retail trader (a non-professional trader). So, just because you saw an add for 1:500 or 1:1000 online, it does not mean that you will actually be able to access that leverage. Make sure you know which rules that apply to leverage in your jurisdiction, including rules about mandatory Negative Account Balance Protection for retail accounts.

In jurisdictions where leverage is capped for retail traders, the general cap is typically 1:30 and then there are lower caps in place for especially risky assets. CySEC does for instance enforce a 1:30 cap for major forex pairs, and a 20:1 leverage cap for all other forex pairs. If any of the currencies involved is a cryptocurrency, the cap is just 2:1.

Withdrawal Process

It’s easy to ignore withdrawal policies early on, when you are more focused on depositing and growing your account. But when you finally hit a good run and want to pull profits, or you decide this broker or platform is not the right one for you, it is horrible to run into withdrawal issues.

Ideally test the withdrawal process early on, when you still do not have much money in your account. This will also give you a chance to get any remaining know-your-customer checks out of the way, before you are in any real hurry to get cash.

Reputable brokers make the withdrawal process easy, while still adhering to the law when it comes to identity and residency verification. If you request a payout and suddenly get hit with strange new verification delays, surprise fees, or unexplained silence, that’s a red flag.

Before you sign up with a broker, read real user reviews. Find out how fast they pay and what the experience is like when you actually ask for your money. If a broker makes it hard to leave — that’s not a partner. That’s a trap.

Customer Support

Test their support. Ask them a real question. See how fast and clearly they respond. Some brokers offer 24/5 live chat and phone access. Others bury their contact form five clicks deep and take three days to answer a basic email.

Make sure you can access the support even when you are not logged into the trading platform. Otherwise, who will help you if you are experiencing problems logging in?

This article was last updated on: August 17, 2025